Do the University’s financial reports support the need to make job cuts?

University management claims that proposed staff cost cutting measures are needed to save money- but do the audited accounting reports back this claim up?

On this page

- Background

- The current financial position

- What cuts are the University planning to make?

- Do the figures support these staff cuts?

- What can be done about this?

Background

In a very basic sense of financial management, as with any organisation, the University can run either a surplus or deficit in a given year:

- When the university earns more cash (through sources such as tuition fees and research grants) than it spends, we end up with a cash surplus.

- If the opposite is true and there’s more spending than earning in a given year, we end up with a cash deficit.

Normally, a surplus is expected, but fluctuations in student recruitment and other factors may lead to a deficit every once in a while. This is to be expected in a large organisation, and should be mitigated through risk management measures. These measures should identify the risks and mitigate them strategically, for example by changing the sorts of goods and services that you supply, or shifting into a new market.

A good risk management process will identify and make these changes gradually without disrupting the operations or resorting to large scale human/financial costs (like firing or massive restructuring of employees).

From an operational perspective, one of the most important parts of risk management is to consider ways to manage short term fluctuations in revenue and cost. For example:

- To manage a surplus, cash can be deployed to buy real estate, or invest in securities like government bonds etc.

- To manage a deficit, institutions can borrow (loans) from banks, or liquidate their assets and investments.

In a year where there is a cash surplus, this can be either saved in the University’s cash reserves, or deployed to create assets, including capital assets like buildings.

We are convinced that there have been serious failures in the University’s approach to risk management in terms of managing the strategic risk inherent in its student recruitment strategy, and in particular its overreliance on China as a market for international student recruitment. University management has failed to take any accountability for the impact of these financial choices.

The current financial position

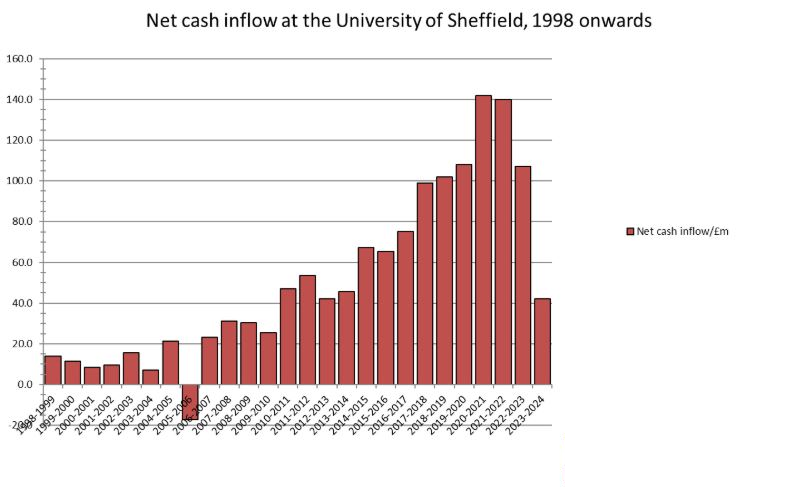

The chart below shows that the University has run a cash surplus every year since 05/06 until 23/24 (the latest year for which data are available):

Source: University Annual Reports (https://sheffield.ac.uk/finance/annual-report-financial-statements)

One major use of the surplus has been to fund the University’s capital spending (on things such as new buildings). The value of our assets (net book value) grew from £598m in 2010-11 to £1,762m in 2023-24.

Even with such investment into Capital, the university was left with £221 million in cash reserves at the end of 23-24 (23-24 annual report), and a significant amount of capital assets on its balance sheet

The healthy position going into the student recruitment problems is highlighted by the University’s favoured measure of profitability, EBITDA, which has remained positive even in the 24-25 financial year (xlsx file, 10.9kb. Source: University Annual Reports) that saw the big squeeze in student numbers.

Student numbers are also expected to stabilise in future years, according to data shared with staff at the All-Staff Briefing on 13th October 2025.

In 2024-25, we targeted to generate a cash surplus (in terms of EBITDA) of 11%, but it’s forecast that we will end up with a surplus of 6% of our adjusted income.

Although this is less than the University’s target, the university is not expecting (as per its KPI parameter) to end up with a negative, and therefore is in line with the parameters of the Key Performance Indicator that it must abide by in this regard) i.e. not spending more than it is earning in this context.

Source: Institutional KPI dashboard, UoS.

The annual statements until 23-24 also note that the university doesn’t have any major loans.

In order to manage the cash problem that the university apparently has, given the strong capital assets and reserve position, coupled with the positive cashflows, there is no danger of the University going bankrupt or being unable to service its obligations.

What budgetary cuts are the University planning to make?

In the All Staff Briefing on 13/10/25, it was claimed that the University needs to make these savings across the following years:

- 24-25 – £28.4m (Fully achieved)

- 25-26 – £50.7m (£40m achieved so far, further £10.6m needed)

- 26-27 – £74.0m (£47m achieved so far, further £27m needed)

The University has indicated that it intends to make most of these savings through cuts to staffing budgets, including potentially by imposing compulsory redundancies, although they have indicated a preference to use alternative means such as voluntary severance where possible.

Do the figures support these staff cuts?

In short- no. The University remains in a healthy financial position and is not in any immediate or serious financial danger. There is no current threat to liquidity, as the University has plenty of cash available to meet its obligations.

Although savings do need to be made to ensure that our revenue matches our spendings in the long run to manage the University’s financial risk, these can be made through:

- Using part of the over £200m currently held in cash reserves

- Making non-staff cost cuts, such as scaling back capital projects and selling off unnecessary buildings and other assets.

- Extending the break-even target to 4 or more years instead of 3 to give more time to make any savings needed.

Through these measures, we believe that the University could remain financially viable as a going concern without having to make as many cuts as it proposes to make to staff budgets, or as quickly as it proposes to make them.

While the University does need to make savings, there is no financial need for its commitment to compulsory redundancies and the wider attacks it is making on the job security of its staff.

We also believe the University is driving these cuts out of ideological desire – rather than financial necessity, increasingly treating the University as a pure business rather than an academic institution.

What can be done about this?

Our current dispute aims to show University management that staff will not accept the sweeping reductions to jobs that are currently planned, and through negotiations we are working to convince University management that there is no need for these proposed cuts.

You can help us put pressure on them to come to an agreement by joining or supporting our industrial action, and by joining UCU if you’re not yet a member!